Impact of AI on Banking

Optima AI FinTech Series

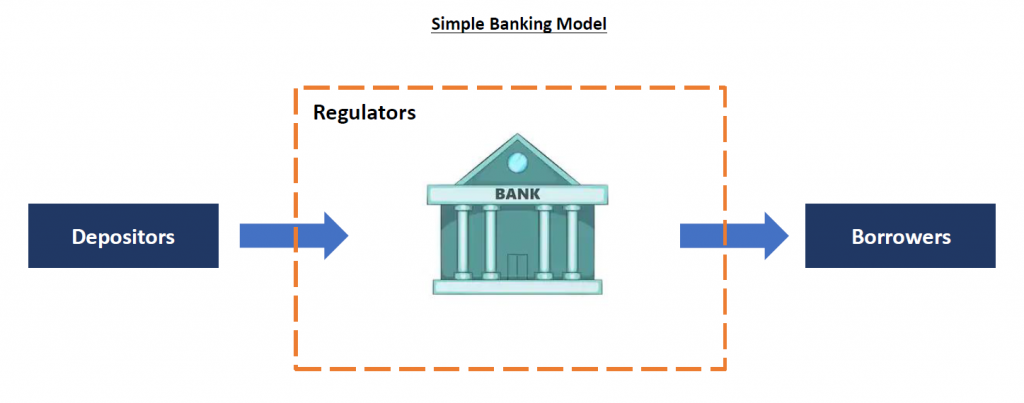

Banking is one of the most promising industries to benefit from Artificial Intelligence (AI). In a previous post, I explored the basics of the technology and its impact on the financial services. In this post, I focus on the effects of AI on the banking sector. For the purpose of this post, I use a simple bank model, which includes depositors, borrowers and regulators in the perimeter, and internal operation at the core. AI offers great potential to improve services at the core and perimeter, and I am going to briefly describe the possible applications of AI in banking.

AI at the Perimeter – Depositors

Depositors park their money in banks to secure it and earn interest. As a result, depositors care about customer service, product offerings and the safety of banks. AI can enhance the banking experience for depositors in all of these areas. The role of AI continues to become more prominent as the digitization of banks accelerates in the United States. Demographic changes as well as the convenience of digital solutions have fueled the transformation of banks toward digitization. Banking offerings are ideal for digitization as most of them are intangible and standard across banks. AI will be a catalyst to steer banking toward complete digitization as the technology results in new offerings that are superior to the branch experience.

Online and mobile banking limitations, product complexity and the onboarding process have led many Americans to continue visiting a branch for their banking needs. For instance, “60% of Americans prefer to go to a branch to open a new account” according to a survey by Novantas even though overall branch engagement is declining. It seems that people still prefer in-person account opening in order to have the full support of branch staff. This trend will probably change in the future as the online onboarding process becomes easier and supported by 24/7 chatbots.

New AI technologies will significantly improve the interaction between banks and depositors. Instant 24/7 customer service, personalized offerings and self-driving financial solutions will tip the scale toward mobile banking. A major consideration on this migration would be safety and security of digital banking. According to PwC’s 2018 Digital Banking Consumer Survey, 65% of people feel it is important to have a local branch, and 25% would not open an account with a bank that does not have at least one local branch. It is paramount that banks address this issue and prioritize digital security. On the security front, artificial intelligence plays an important role by enabling banks to reduce fraud and human error through checks and monitoring.

AI at the Perimeter – Borrowers

Consumers and corporations are constantly borrowing from banks. Borrowers, especially high-quality ones, choose their lenders based on a competitive interest rate, approval requirements, timeline and existing relationships. The current process is usually burdensome, opaque and complex, making borrowers seek hand holding throughout the process. AI-enabled models significantly improve this process by providing accurate interest rate estimates before bombarding the applicant with paperwork. Furthermore, banks can benefit from automated and accurate underwriting engines that meaningfully expedite the process. Similar technologies have enabled firms, such as Affirm to provide real-time financing at the point of sale.

After loan executions, intelligent softwares can help monitor loans, predict and detect the troubled loans. Predictive analytics enables lenders to evaluate the likelihood of defaults and manage the overall loan portfolio. Finally, AI systems improve the collection process by matching collection agents and borrowers through smart algorithms, augmenting agent conversations with AI recommendation models and de-biasing the decision-making processes. According to McKinsey & Co. “banks adopting psychological interventions in consumer collections have achieved a 20 to 30 percent increase in the amount collected.”

AI at the Perimeter – Regulators

The banking industry is heavily regulated which adds an enormous burden on banks. Regulatory compliance has been a drag on banks’ efficiency metrics, especially since the financial crisis. Furthermore, compliance violations lead to severe disciplinary actions, jeopardizing the health of the violating institution. In today’s complex banking systems, the use of tech-enabled monitoring systems seems inevitable. The sheer volume of transactions and exponential growth in data have complicated the monitoring process. On the other hand, the high volume of data creates an ideal environment to use AI-based solutions. Either in Anti Money Laundering (AML) or Know Your Customer (KYC) rules, AI solutions help bank employees to dig deeper and review voluminous data in a short amount of time.

AI at the Core

The core operation of a bank is designed to facilitate services and products for the perimeter counterparts: depositors, borrowers and regulators. In simple terms, the profitability of a bank depends on the spread between the lending and borrowing rates adjusted for default losses, cost of operation and fraud. To maximize profitability, banks need to maximize the credit spread while minimizing the default amount, fraud and operational expenses. AI technology is well suited to improve all of these processes. The predictive power of AI enables banks to price their products accurately. Banks can increase revenue by effective cross selling through AI-powered recommendation engines.

Underwriting is another critical process that can become more accurate by identifying the most important factors while reducing human bias in decision making. Much of the back-office tasks can either be automated or expedited through the use of intelligent tools. For instance, JP Morgan & Chase Co. is a leading bank in AI deployment and uses the technology for a variety of applications. As a result of deploying AI in fraud applications, the bank is expecting “to drive $150 million of annual benefits and countless efficiencies.” Furthermore, the bank predicts that AI will “dramatically improve AML/Bank Secrecy Act protocols and processes as well as other complex compliance requirements.” As the deployment of intelligent solutions continues, the banking sector should expect “a new norm” of efficiency ratios. In turn, the competitive landscape will transform significantly, and the winners will look more like technology companies than traditional financial institutions.

Banking Data and AI Strategies

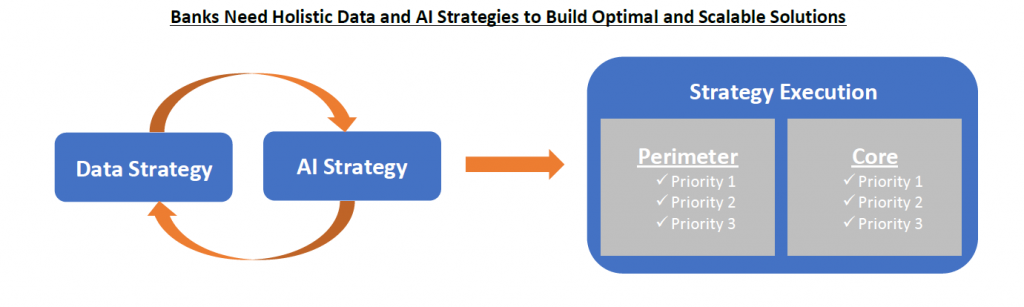

There are numerous AI solutions that enhance banking services in the perimeter and core. The question is, how can banks implement these solutions without disrupting operation? The answer depends on the technological capabilities, infrastructure and risk appetite of the bank. A bank may need to do substantial preparation to setup the infrastructure necessary to implement a robust and scalable AI solution. Data is the oil to the AI engine, so the first step is to assess the data availability, quality, flow and security. Having a data strategy positions the bank to have the right systems for data-driven solutions. It is crucial for banks to accumulate the data today for any potential AI implementation in the future.

The second step is to form an AI strategy by mapping all possible AI products and evaluate the costs and benefits. The strategy should come with an execution roadmap as well as expected ROIs. Multiple iterations between AI and the data strategies may be required to find an optimal solution.

Optima AI is an AI and ML consultancy firm that helps financial firms plan and execute their AI and data strategies. Our team of banking experts and technologists provide detailed solutions that are needed by banks to grow in the digital era.

Related Posts

Leave a Reply Cancel reply

Categories

- Cloud Computing (2)

- Computer Vision (6)

- Financial Services (2)

- Health Care (2)

- Marketing (1)

- Predictive Analytics (3)