Optima AI FinTech Series

Impact of Artificial Intelligence on the Financial Services Industry

While Artificial Intelligence (AI) has become a household name, practical implications and uses of the technology are still opaque. In order to evaluate the impact of AI on the financial services industry, it is important to have an overview of the technology first. Artificial intelligence is a broad term, and refers to intelligence demonstrated by computers. Most AI applications that are currently being developed belong to a subset of AI, called Machine Learning (ML). Most existing ML applications use historical events and data to “train” intelligent models that are capable of predicting future events and deriving actionable decisions. For example, a machine learning algorithm “learns” to identify cats in images by “looking” at a large set of already identified cat images. ML algorithms often become more powerful with a larger training dataset. It is also important to note that most machine learning applications rely on supervised learning, meaning that the historical training data should be labeled by humans so that the machine can “learn.” Going back to the cat example, these features mean that 1) the more cat images for training will lead to a more accurate cat recognition by the machine 2) the cat images should have been identified as cats by humans first, so that the machine can be trained. The promise of machine learning is that given large enough training data and a well-designed model, a machine can surpass human-level accuracy.

Knowing the premise of machine learning, it is obvious that financial services must offer a great opportunity to apply the technology. Financial services is a data-driven industry with rich historical data, hence a large training dataset. This opportunity has drawn a lot of attention by incumbents and new entrants alike. Most segments of the industry, such as banking, insurance and investment management can benefit from AI and ML. Each segment can utilize the technology in multiple areas in order to enhance efficiency, reduce error and speed up processing. In future publications, I would be investigating how AI is impacting each segment of the financial services in more details. Here we review some of the technological highlights, industry trends and few points of consideration.

There are several fundamental AI technologies that are developed at universities and the research departments of technology companies that are fundamental to several applications in the financial services. A brief overview of these AI technologies and applications will depict the spectrum of possibilities available to the financial institutions.

Predictive analytics: predictive power is one of the most fundamental applications of AI in the financial services. Inherently predictive tasks, such as loan underwriting in banking, contract underwriting in insurance and market prediction in investment management are the bread and butter of financial institutions. While these institutions have been using a variety of tools to achieve predictive power, machine learning is emerging as a powerful method. Machine learning can potentially derive the best predictions and does so in a fraction of the time. For instance, a bank can use state-of-the-art underwriting methods to lower the default rate, increase loan generation and expedite the process. Such improvements have already expanded the universe of borrowers by providing underwriting services for the underbanked population.

Chatbots: in the era of mega banks, providing efficient and effective customer service has emerged as a costly and challenging endeavor, requiring an army of representatives. Despite all efforts, we have all experienced the long holds over the phone and the rigorous transfer game to reach the “right person.” Those days are outnumbered. Specialized chatbots are becoming available 24/7 to address customers’ requests and concerns. Bank of America’s AI-driven chatbot, Erica, is a great example of addressing customer needs via such services. According to Bank of America’s 2018 annual report, more than 5 million customers have used the service since its launch in the spring 2018. It is noteworthy that chatbots can also be applied for internal operations as well, driving significant efficiency.

Image recognition: image recognition is one of the most fascinating applications of AI. The latest innovations in convolutional neural networks have resulted in significant improvements in the accuracy of image recognition models and their adoption across the industry. The precision of AI-powered facial identification systems have reached a point that competes with trained facial examiners. Such systems open up opportunities to expand banking services to the most remote areas while expediting the onboarding process.

Natural Language Processing (NLP): NLP is another field that has tremendously benefited from advancements in AI. In summary, NLP is the science that let machines and humans interact in natural language. While the effects of frictionless communication between machines and humans is profound, there are certain applications of NLP that are being utilized in the financial services industry today. An example of such applications is the use of sentiment analysis in investing. In late 2018, Two Sigma, a hedge fund based out of NY, launched a public data science competition aimed at predicting stock price movements through the analysis of news sentiments via NLP.

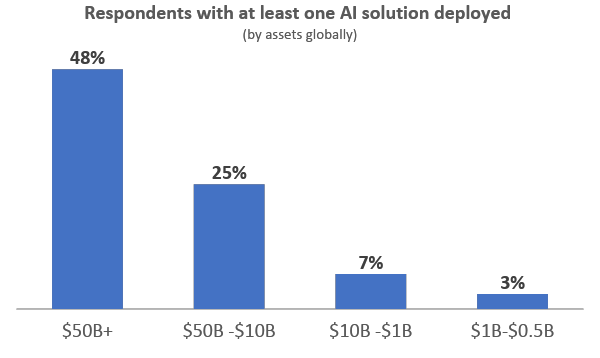

The items mentioned above are just brief descriptions of major AI accomplishments that can branch into countless applications and use cases. The AI capabilities have enticed many financial players to pursue applying the technology in their business models. However, the response has not been uniform. From the incumbents, big banks have been the ones embracing the new technology the most. DBR Research points out to this uneven response (see the chart below).

Source: DBR Research

On the other hand, the opportunity for deployment of AI in the financial industry has led to a record-breaking global investment in FinTech by VCs in 2018. Based on Innovative Finance report, “2018 was a record-setting year for venture capital investment in FinTech with $36.6 billion invested globally, representing a 148% or 2.5x increase over 2017.” It must be noted that there are other technologies besides AI that contribute to the inflow of capital to FinTech startups, but AI is a major trend among FinTech startups.

Despite machine learning’s enormous potential, incumbents and new entrants must pay attention to risks and considerations in order to build a sound and solid AI foundation for the financial services industry. Some of the major risks and considerations include bias risk, systematic risk, regulations and data & privacy.

Bias risk: as mentioned earlier, machine learning models are often trained on historical data labeled by humans. If there is a human bias, including but not limited to discrimination, it would cause the machine to “learn” to be biased. For example, if the consumer lending unit of a bank uses historical training data from an era that women were less likely to apply and get approved for loans, then the machine may interpret that women are less creditworthy, and deprive them from borrowing.

Systematic risk: systematic risk plays a crucial role in the stability of financial markets. It is unknown how the risk can change in a system that heavily relies on AI. Let’s assume more and more investment managers start using AI for investing, to the point that AI models initiate the majority of trades. Since similar historical data is used for the training of such algorithms, a major event can cause all the machines to take similar actions, exacerbating price changes and destabilize the market.

Regulations: the regulatory aspects of new technologies in the financial services industry are still unclear. The Fed, Treasury and FSB have all published reports on proliferation of new technology in the financial services. The overall reaction has been positive in order to foster growth and innovation, and it seems that the agencies are in learning and listening mode. It would be interesting to observe how regulators will react to the widespread use of AI in the financial system, especially when certain algorithms present black box solutions.

Data & privacy: machine learning does heavily rely on data. This aspect of the technology alone may transform the financial services industry as we know it. The future value of financial institutions will not only be measured by their asset quality and efficiency ratios but also by their data assets. As a result, data plays an important role in the future of strategic decisions.

This article is a brief introduction into artificial intelligence, machine learning, and some financial applications along with their risks and considerations. In future articles we will further explore these topics in detail. At Optima AI, our team strives to facilitate the use of AI and ML in the financial services industry by helping financial institutions identify opportunities, define AI strategy, and execute their AI solutions.

Related Posts

Leave a Reply Cancel reply

Categories

- Cloud Computing (2)

- Computer Vision (6)

- Financial Services (2)

- Health Care (2)

- Marketing (1)

- Predictive Analytics (3)